2023 Renters Rebate Form NJ – The 2023 Renters Rebate Form NJ is here to provide financial relief and ease the burden of renting a home. In this comprehensive guide, we’ll delve into the details of this valuable program, guiding you through the process of claiming your rebate.

Understanding the Renters Rebate Program

What is the Renters Rebate Program?

The Renters Rebate Program is a state initiative designed to assist low and moderate-income renters in New Jersey. Its immediate purpose is to deliver financial relief to individuals and families facing the challenge of high rental costs.

Eligibility Criteria

To qualify for the Renters Rebate Program, individuals must meet certain eligibility criteria, including:

- Residency: Applicants must be New Jersey residents and occupy a rental property as their primary residence.

- Income Limits: The program is intended for low and moderate-income individuals. Specific income limits are set each year, so it’s essential to check the current guidelines.

- Age Requirement: Applicants must be at least 65 years old or disabled.

- Property Taxes: Applicants must have paid property taxes directly or through rent.

The Benefits of the Renters Rebate Program

Enrolling in the program comes with several benefits, including:

- Financial Assistance: Eligible applicants can receive a substantial rebate, reducing the financial strain of renting.

- Support for Seniors and Disabled Individuals: The program emphasizes assisting senior citizens and disabled individuals, ensuring they can maintain affordable housing.

How to Apply for the 2023 Renters Rebate

Gathering Required Documents

Before starting your application, gathering the necessary documents, such as proof of residency, income statements, and proof of property tax payments is crucial.

Filling Out the Application

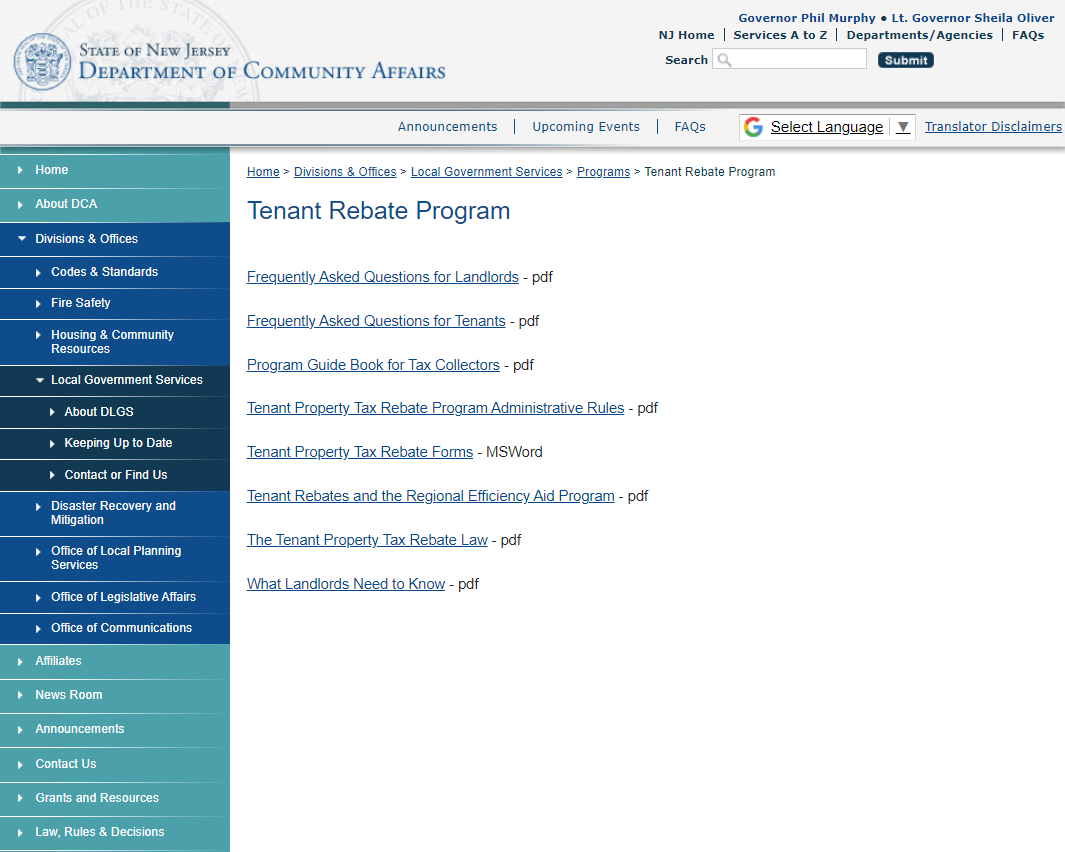

The application form can exist accepted online or from your local New Jersey Division of Taxation office. It’s essential to complete the form accurately and thoroughly, ensuring all required information is provided.

Submission and Deadline

Submit your application before the specified deadline. Be sure to double-check the submission requirements to ensure timely processing of your rebate.

The Process of Rebate Calculation

Determining Rebate Amount

The rebate amount is calculated based on various factors, including your income, the amount of property taxes paid, and the number of dependents. The calculation can be complex, but the program’s guidelines provide clear instructions.

Expected Waiting Period

Behind presenting your application, there choice be a waiting period for processing your rebate. The exact duration may vary, but it’s essential to be patient during this phase.

Receiving Your Rebate

Direct Deposit

Rebates are typically issued through direct deposit. Ensure that you provide accurate bank account information on your application to receive your rebate promptly.

Check by Mail

You can indicate this on your application if you prefer to receive a physical check. Be aware that this option may take slightly longer.

Conclusion

The 2023 Renters Rebate Form NJ is a valuable resource for New Jersey residents struggling with high rental costs. By understanding the eligibility criteria, application process, and rebate calculation, you can take advantage of this program to alleviate your financial burden and secure affordable housing.