Citibank Drivers Edge – Citibank Driver’s Edge is a credit card designed specifically for those who spend a significant amount on driving-related expenses. It offers rewards and benefits tailored to motorists, making it a popular choice among car owners and commuters alike.

Benefits of Citibank Driver’s Edge

One of the key benefits of the Citibank Driver’s Edge card is its cashback rewards on gas purchases and auto maintenance. Additionally, cardholders can enjoy other perks such as roadside assistance and travel insurance.

How Does It Work?

The card works like any other credit card but with added incentives for automotive-related spending. Every time you use the card for gas, auto repairs, or maintenance, you earn points that can be redeemed for rewards.

Features of Citibank Driver’s Edge Card

Here’s a summary of the features of the Citibank Driver’s Edge Card:

- Cashback Opportunities: Earn cashback on eligible gas purchases and auto services, leading to potential savings for frequent drivers.

- Fuel Savings: Benefit from fuel savings at participating gas stations, helping you save money every time you refuel.

- No Annual Fee: The card comes with no annual fee, making it a budget-friendly choice for cardholders.

These features make the Citibank Driver’s Edge Card a valuable option for those looking to save on gas and auto-related expenses without worrying about an annual fee.

Eligibility and Application Process

Here’s the information about the eligibility and application process for the Citibank Driver’s Edge Card:

Eligibility for Citibank Driver’s Edge

Who Can Apply?

- Age Requirement: Applicants must be at least 18 years old.

- Income Requirement: A minimum income level is required, which may vary depending on the card’s terms and conditions.

- Credit Score: Typically, a good to excellent credit score is required for approval.

Application Process

How to Apply?

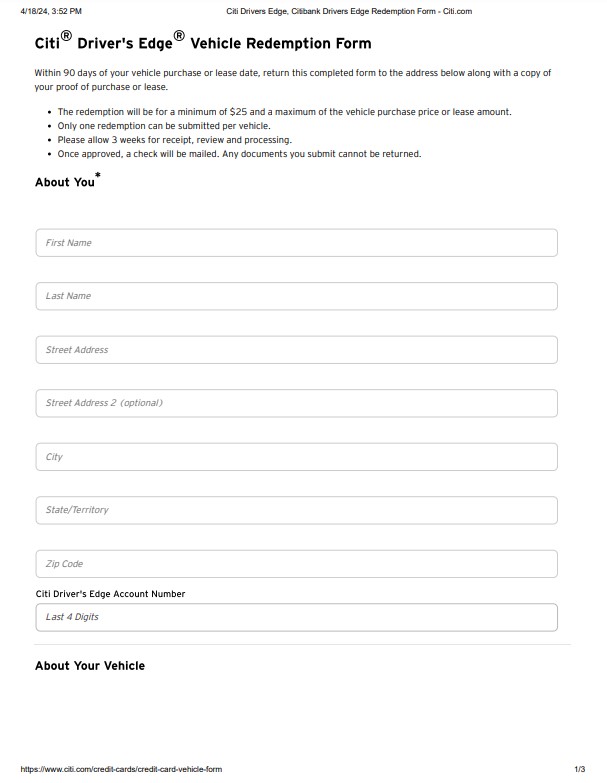

- Online: Visit Citibank’s official website and navigate to the credit card section to fill out the online application form.

- In-Branch: Alternatively, you can apply by visiting a Citibank branch and speaking with a representative.

Required Documents

During the application, you’ll be asked to provide several documents to verify your identity, income, and address. These may include:

- Proof of Identity: Valid government-issued ID such as a passport or driver’s license.

- Proof of Income: Recent pay stubs, tax returns, or bank statements to verify your income.

- Proof of Address: Utility bills, rental agreement, or a recent bank statement with your current address.

Having these documents ready will help streamline the application process and increase your chances of approval.

The application process for the Citibank Driver’s Edge Card is generally quick and straightforward, and once approved, you can start enjoying the card’s benefits right away.

Citibank Driver’s Edge Rewards

Accumulating Points

Earn Points: Every eligible purchase made with your Citibank Driver’s Edge card earns you points. The more you use your card, the more points you accumulate over time.

Redeeming Rewards

Variety of Rewards: Once you’ve gathered a sufficient number of points, you can redeem them for various rewards.

- Gift Cards: Choose from a selection of popular retailers and brands.

- Travel Vouchers: Use points to book flights, hotels, or vacation packages.

- Cashback: Convert your points into cashback to be credited to your account.

Additional Perks

- Travel Insurance: Enjoy peace of mind with complimentary travel insurance coverage when you book travel using your Citibank Driver’s Edge card.

- Extended Warranty Coverage: Extend the manufacturer’s warranty on eligible purchases made with your card.

- Roadside Assistance: Receive 24/7 roadside assistance services, including towing, tire changes, and fuel delivery, whenever you need help on the road.

These additional perks make the Citibank Driver’s Edge Card not only rewarding but also beneficial for travelers and shoppers alike. By using the card for everyday purchases and eligible expenses, you can maximize your points and enjoy valuable rewards and benefits.

Tips to Maximize Your Citibank Driver’s Edge Benefits

Comparing Citibank Driver’s Edge with Other Cards

Citibank vs. Competitors

- Automotive-Focused Rewards: Unlike many general rewards cards, Citibank Driver’s Edge is tailored towards automotive-related spending. This makes it particularly appealing for those who spend a significant amount on gas, auto maintenance, and related expenses.

- No Annual Fee: One of the standout features of Citibank Driver’s Edge is its lack of an annual fee. This makes it a cost-effective option for cardholders who want to enjoy rewards without worrying about recurring charges.

Unique Selling Points

- Fuel Savings: The card offers fuel savings at participating gas stations, which can lead to significant savings over time for frequent drivers.

- Cashback Opportunities: Earn cashback on eligible purchases, further enhancing the card’s value and appeal.

- Additional Perks: Beyond rewards, Citibank Driver’s Edge provides extra benefits like roadside assistance, travel insurance, and extended warranty coverage, adding more value to the cardholder experience.

When compared to other rewards cards in the market, Citibank Driver’s Edge stands out for its specialized automotive rewards, no annual fee, and a range of additional perks. These unique features make it a compelling choice for individuals who want to maximize their savings on automotive expenses while enjoying valuable rewards and benefits.

Customer Reviews and Testimonials

Certainly! Here’s a summary of customer reviews and testimonials for the Citibank Driver’s Edge Card:

Positive Feedback

- Generous Rewards: Numerous cardholders appreciate the card’s generous rewards, especially its focus on automotive-related spending. The ability to earn points on gas purchases and auto services is often highlighted as a major benefit.

- Fuel Savings: Many users commend the fuel savings offered by the card at participating gas stations, stating that it provides tangible savings on their monthly expenses.

- Excellent Customer Service: Citibank Driver’s Edge is often praised for its responsive and helpful customer service team, who assist cardholders with inquiries, issues, and concerns in a timely manner.

Areas of Improvement

- Limited Acceptance: Some customers have noted that the card’s acceptance is limited at certain gas stations or merchants, which can be inconvenient when trying to maximize rewards.

- Complex Rewards Program: A few users find the rewards program to be somewhat complex or difficult to understand, suggesting that it could be simplified for easier redemption and tracking.

The Citibank Driver’s Edge Card receives mostly positive reviews from cardholders who appreciate its rewards, fuel savings, and customer service. However, there are areas where customers feel improvements could be made, such as expanding acceptance and simplifying the rewards program. Despite these concerns, many users find the card to be valuable for its unique benefits and perks tailored towards automotive enthusiasts and frequent drivers.

Conclusion

Overall, Citibank Driver’s Edge is a great option for those who spend a lot on driving-related expenses. With its generous rewards, fuel savings, and no annual fee, it offers excellent value for money. However, it’s important to use the card responsibly and stay updated on offers to maximize your benefits.

Download Citibank Drivers Edge

FAQs

- What is the annual fee for Citibank Driver’s Edge?

- Citibank Driver’s Edge has no annual fee, making it a cost-effective option for cardholders.

- How do I redeem my cashback rewards?

- You can redeem your cashback rewards through Citibank’s rewards portal or by contacting customer service.

- Is there a limit to the rewards I can earn?

- There is no limit to the rewards you can earn with Citibank Driver’s Edge.

- Can I use the card internationally?

- Yes, you can use your Citibank Driver’s Edge card internationally, but keep in mind that foreign transaction fees may apply.

- How do I contact Citibank customer service?

- You can contact Citibank customer service through their website, mobile app, or by calling the number on the back of your card.