The P87 Form, or Tax Relief for Expenses of Employment form, is a tool offered by Her Majesty’s Revenue and Customs (HMRC) in the UK. It’s designed to help employed individuals seek tax relief on specific expenses they’ve had to cover for work-related purposes.

When you fill out a P87 Form, you’re essentially telling HMRC about the expenses you’ve incurred during your employment that you believe qualify for tax relief. These expenses could include things like business travel, professional subscriptions, or necessary equipment you’ve had to purchase for your job.

Claiming tax relief through the P87 Form can potentially reduce your taxable income, meaning you’ll pay less tax overall. It’s a way for HMRC to acknowledge and accommodate the costs associated with doing your job.

Eligibility Criteria for Using the P87 Form

To be eligible to use the P87 Form provided by HMRC, you need to meet certain criteria:

- UK Taxpayer: You must be a taxpayer in the United Kingdom.

- Incurring Employment-Related Expenses: You should have incurred expenses directly related to your employment. These expenses could cover a range of items such as tools, uniforms, business travel costs, professional subscriptions, and other necessary expenditures directly linked to your job.

- Expenses Not Reimbursed by Employer: The expenses you’re claiming tax relief for must not have been reimbursed by your employer. If your employer has already reimbursed you for these expenses, you generally cannot claim tax relief on them.

Meeting these criteria ensures that you’re eligible to utilize the P87 Form to claim tax relief on qualifying employment-related expenses. It’s important to accurately report your expenses and ensure they meet HMRC’s guidelines to avoid any issues with your claim.

How to Access the P87 Form

Accessing the P87 Form from HMRC is straightforward and can be done in a couple of ways:

- Official HMRC Website: You can download the P87 Form directly from the official HMRC website. Navigate to the section related to forms or tax relief, where you should find the P87 Form available for download in PDF format. You can then print it out and fill it in manually or fill it in digitally if your PDF viewer supports form filling.

- Request by Phone: If you prefer not to download the form yourself, you can contact HMRC directly by phone and request a copy of the P87 Form. They will be able to send it to you either electronically or by post, depending on your preference.

By accessing the P87 Form through these channels, you can begin the process of claiming tax relief on eligible employment-related expenses efficiently and accurately.

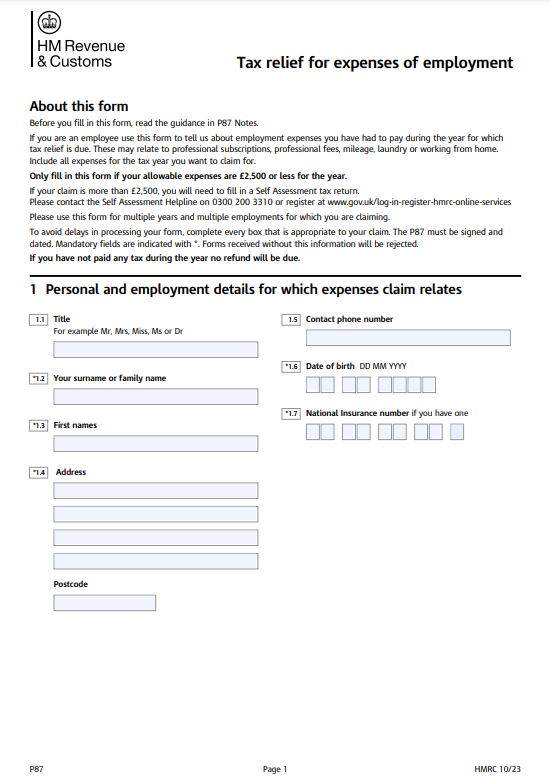

Completing the P87 Form

Completing the P87 Form provided by HMRC is a relatively simple task. Here’s a breakdown of the key steps involved:

- Personal Information: Begin by filling in your personal details, including your full name, address, National Insurance number, and your employer’s name and address. Ensure that all information is accurate and up-to-date.

- Employment Details: Provide information about your employment, such as your job title, employer’s PAYE reference number, and the start and end dates of your employment if applicable.

- Expense Details: List the expenses you’re claiming tax relief for. This may include expenses like business mileage, professional subscriptions, uniform and tools costs, or other relevant expenses related to your job. Make sure to provide detailed information about each expense, including the amount spent and the date incurred.

- Declaration: Sign and date the declaration section of the form, confirming that the information provided is accurate and complete to the best of your knowledge.

- Submission: Once you’ve completed the form, you can submit it to HMRC either electronically or by post, depending on your preference and the instructions provided on the form or the HMRC website.

Double-checking the information you’ve provided is crucial to avoid any errors or discrepancies that could delay processing or lead to your claim being rejected. Taking the time to ensure accuracy will help expedite the process and increase the likelihood of a successful claim for tax relief on your employment-related expenses.

Submitting the P87 Form

Once you’ve completed the P87 Form, you have the option to submit it to HMRC either online or by post:

- Online Submission: If you choose to submit the form online, you can typically do so through the official HMRC website. Visit the relevant section for submitting forms or tax relief claims, and follow the instructions provided. You may need to create or log in to your HMRC online account to complete the submission process. Online submission is often faster and more convenient, and it allows you to track the status of your claim electronically.

- Postal Submission: Alternatively, you can choose to submit the completed P87 Form by post. Ensure that you have filled out all the required sections accurately and signed the declaration. Then, send the form to the address provided on the form or on the HMRC website. Allow sufficient time for the form to reach HMRC by mail, and consider using recorded delivery or another tracked postal service for added security and peace of mind.

Regardless of the submission method you choose, it’s essential to retain a copy of the completed form for your records. This will serve as proof of your claim and the information you provided in case of any inquiries or follow-ups from HMRC.

Processing Time and Outcome

After you submit your P87 Form to HMRC, the processing time typically takes a few weeks. During this period, HMRC will review the information provided on the form and assess your eligibility for tax relief based on the expenses you’ve claimed.

Once the processing is complete, you will receive confirmation from HMRC regarding the outcome of your claim. This confirmation will include whether your claim has been approved or denied. If your claim is approved, HMRC will also specify the amount of tax relief you’re entitled to receive.

If your claim is approved, the tax relief amount will usually be reflected in your tax code, which will result in a reduction of the tax you pay through your salary. Alternatively, if you’re due a refund for previous tax years, HMRC will issue a refund accordingly.

It’s important to note that processing times may vary depending on HMRC’s workload and the complexity of your claim. However, you can typically expect to receive a response within a few weeks of submitting your P87 Form.

Potential Rejections and Appeals

If HMRC rejects your P87 Form, it could be due to various reasons, such as incomplete or inaccurate information, insufficient evidence to support your claim, or the expenses not meeting the eligibility criteria for tax relief. However, you have the option to appeal the decision if you believe it was made in error or if you have additional evidence to support your claim.

Here’s what you can do if your P87 Form is rejected:

- Review the Rejection Notice: Carefully review the notice provided by HMRC explaining why your claim was rejected. This will help you understand the specific reasons for the rejection and what steps you need to take to address them.

- Provide Additional Evidence: If your claim was rejected due to insufficient evidence or information, gather any relevant documents or receipts that support your claim. Make sure to include these when you submit your appeal to HMRC.

- Clarify Information: If the rejection was due to incorrect or unclear information on the P87 Form, provide clarifications or corrections as necessary. Ensure that all details are accurate and complete before resubmitting the form or appealing the decision.

- Submit an Appeal: Once you’ve gathered any additional evidence or clarified information, you can submit an appeal to HMRC. This typically involves writing a letter explaining why you believe your claim should be reconsidered and providing any supporting documents or evidence. Follow the instructions provided by HMRC for submitting appeals.

- Follow Up: After submitting your appeal, HMRC will review your case and make a decision. Be patient during this process, as it may take some time for HMRC to reassess your claim. You may also need to provide further information or respond to any additional queries from HMRC during the appeals process.

By following these steps, you can appeal a rejected P87 Form and provide additional evidence or clarifications to support your claim for tax relief on employment-related expenses.

Important Deadlines

Though there isn’t a rigid deadline for submitting the P87 Form to HMRC, it’s wise to do so promptly after incurring eligible expenses. By submitting your claim promptly, you ensure you don’t miss out on potential tax relief opportunities. Additionally, timely submission helps in streamlining the processing of your claim by HMRC, reducing the risk of delays or complications.

HMRC typically encourages taxpayers to submit claims for tax relief as soon as possible after incurring the relevant expenses. This ensures that any eligible tax relief can be applied in a timely manner, resulting in potential reductions in your tax liability or refunds for overpaid taxes.

Conclusion

In conclusion, the P87 Form serves as a crucial resource for employed individuals in the UK to seek tax relief on expenses directly related to their work. By familiarizing yourself with the process of completing and submitting the form, you can take advantage of the opportunity to reduce your tax liability and potentially receive refunds for eligible expenses.

Understanding the eligibility criteria, the steps involved in completing the form accurately, and the options for submission—whether online or by post—empowers you to navigate the process efficiently. Remembering to provide thorough documentation and promptly submitting your claim can help expedite the processing and ensure you receive the tax relief you’re entitled to in a timely manner.

Download P87 Form HMRC

Frequently Asked Questions About the P87 Form

- What types of expenses can be claimed using the P87 Form?

- Expenses that are wholly, exclusively, and necessarily incurred in the performance of your duties can be claimed using the P87 Form.

- Can I claim expenses for previous tax years?

- Yes, you can claim expenses for up to four previous tax years, provided you have not already claimed them and meet the eligibility criteria.

- Is there a limit to the amount I can claim?

- There is no fixed limit to the amount you can claim, but your claim must be reasonable and supported by evidence.

- Do I need to provide receipts with the form?

- While receipts are not mandatory for submitting the P87 Form, it’s advisable to keep them as evidence in case HMRC requests further information.

- Can I claim expenses if my employer already reimbursed me?

- No, you cannot claim expenses that have already been reimbursed by your employer.