In the realm of local taxation in the UK, council tax often looms large in household budgets. However, what many residents may not be aware of is the potential for council tax rebates. Among these, the Kirklees Council Tax Rebate holds particular significance for residents in the Kirklees area. Understanding the ins and outs of this rebate scheme can lead to significant savings for eligible households.

What is Kirklees Council Tax Rebate?

Breaking Down the Basics

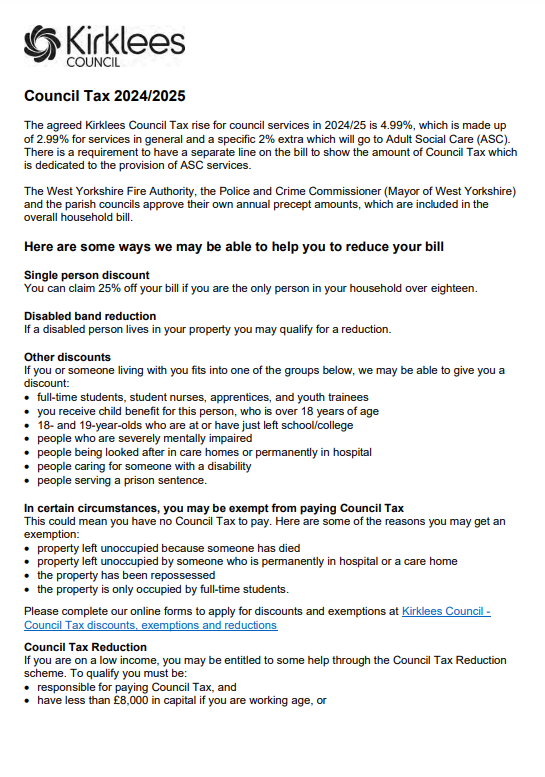

The Kirklees Council Tax Rebate is a financial assistance program offered by the Kirklees Council to eligible residents. This rebate aims to provide relief to households facing financial strain by reducing their council tax liability.

Who is Eligible for Kirklees Council Tax Rebate?

Determining Eligibility Criteria

Eligibility for the Kirklees Council Tax Rebate is based on several factors, including income, residency status, and household composition. Generally, individuals with lower incomes or those receiving certain benefits may qualify for the rebate.

How to Apply for Kirklees Council Tax Rebate?

Navigating the Application Process

Applying for the Kirklees Council Tax Rebate is a straightforward process. Residents can typically apply online through the Kirklees Council website or by submitting a paper application form. Required documentation may include proof of income, residency, and household expenses.

Understanding the Calculation of Kirklees Council Tax Rebate

Unveiling the Formula

The amount of rebate awarded through the Kirklees Council Tax Rebate is determined by various factors, including household income, council tax band, and any applicable discounts or exemptions. The rebate calculation aims to provide meaningful assistance while adhering to established guidelines.

Common Misconceptions about Kirklees Council Tax Rebate

Dispelling Myths and Clarifying Facts

Despite its importance, the Kirklees Council Tax Rebate is often surrounded by misconceptions. Addressing these myths can help ensure that eligible residents avail themselves of this valuable financial support.

Tips for Maximizing Your Kirklees Council Tax Rebate

Optimizing Your Savings Potential

To make the most of the Kirklees Council Tax Rebate, residents can employ various strategies, such as keeping accurate financial records, staying informed about eligibility criteria changes, and seeking assistance from local support organizations.

Impact of Kirklees Council Tax Rebate on Household Finances

Examining the Financial Benefits

For households struggling to make ends meet, the Kirklees Council Tax Rebate can provide much-needed relief. By reducing the burden of council tax payments, the rebate frees up funds that can be allocated to other essential expenses, improving overall financial stability.

Case Studies: Real-Life Examples of Kirklees Council Tax Rebate

Illustrating the Rebate’s Impact

Examining case studies of residents who have benefited from the Kirklees Council Tax Rebate offers insights into its practical significance. These stories highlight the positive outcomes that result from accessing this form of financial assistance.

Conclusion

Seizing Opportunities for Savings

In conclusion, the Kirklees Council Tax Rebate represents a valuable resource for eligible residents facing financial hardship. By understanding the eligibility criteria, application process, and potential benefits, individuals can unlock savings that contribute to their overall financial well-being.

Download Kirklees Council Tax Rebate

FAQs (Frequently Asked Questions)

- Who qualifies for Kirklees Council Tax Rebate?

- Residents with low incomes or those receiving certain benefits may be eligible for the rebate.

- How much rebate can I receive through the Kirklees Council Tax Rebate?

- The amount of rebate varies depending on factors such as household income and council tax band.

- Can I apply for Kirklees Council Tax Rebate online?

- Yes, residents can typically apply online through the Kirklees Council website.

- Is the Kirklees Council Tax Rebate a one-time payment?

- The rebate is usually provided as a recurring benefit, subject to periodic reassessment of eligibility.

- Are there any deadlines for applying for Kirklees Council Tax Rebate?

- While specific deadlines may vary, residents are encouraged to apply as soon as they become eligible to ensure timely receipt of benefits.