Ontario HST Rebate Form – If you’re a resident of Ontario, you may be entitled to an HST (Harmonized Sales Tax) Rebate, which can put money back in your pocket. In this guide, we’ll walk you through the Ontario HST Rebate Form, explaining how to access it, who’s eligible, and how to complete it. Let’s dive into the details.

Understanding HST and its Importance

Before we get into the nitty-gritty of the rebate form, let’s understand what HST is and why it’s important. The Harmonized Sales Tax combines the federal Goods and Services Tax (GST) and the provincial Sales Tax (PST) into a single tax. In Ontario, the HST rate is currently 13%. This tax is applicable to various goods and services, and a portion of it can be rebated to eligible individuals.

Eligibility Criteria for the HST Rebate

Not everyone is eligible for the Ontario HST Rebate. To qualify, you must meet certain criteria. Typically, eligible individuals include low to moderate-income households, senior citizens, and individuals with disabilities. The specific eligibility requirements may change over time, so it’s essential to stay up to date.

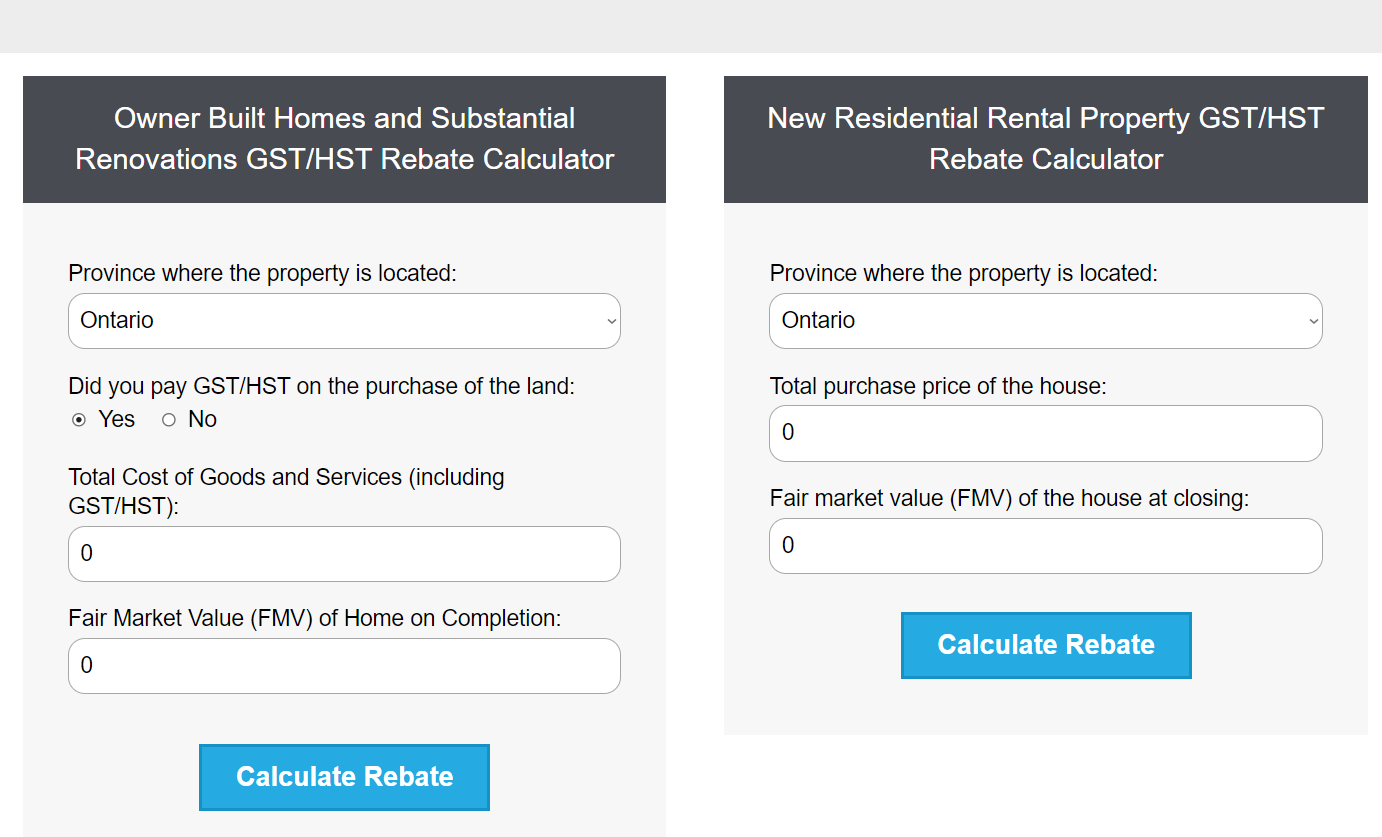

How to Obtain the Ontario HST Rebate Form

Accessing the rebate form is the first step in the process. The form can usually be found on the official website of the Ontario Ministry of Finance. Make sure you download the most recent version of the form to avoid any delays in processing.

Filling Out the Ontario HST Rebate Form

Once you’ve obtained the form, you need to complete it accurately. This involves providing your personal information, including your name, address, and Social Insurance Number. You’ll also need to calculate the amount of your rebate, which can get a bit complex. Ensure you follow the instructions carefully, and if needed, seek assistance.

Common Mistakes to Avoid

Several common mistakes can lead to delays in processing your rebate application. These include incorrect calculations, missing information, or submitting an outdated form. To prevent these issues, double-check your form before submission.

Submitting Your Rebate Form

After completing the form, you’ll need to submit it to the appropriate authority. This usually involves mailing the form to the designated address. Ensure you keep a copy of your application for your records.

Processing Time and Expectations

The processing time for HST Rebate applications can vary. It may take several weeks to several months, depending on the volume of applications. Be patient, and if you’re curious about the status of your application, there might be an online portal where you can check.

How the HST Rebate Benefits Ontario Residents

Receiving an HST Rebate can significantly benefit Ontario residents, especially those with limited income. It eases the financial burden of the HST on essential goods and services, making life a little more affordable.

Conclusion

In conclusion, the Ontario HST Rebate Form is a valuable resource for eligible residents to reduce their tax burden. It’s essential to follow the guidelines carefully, avoid common mistakes, and be patient during the processing period. With this information, you can take advantage of this opportunity to put some money back in your pocket.