Ontario New Housing Rebate Form – In this comprehensive guide, we will delve into the intricacies of the Ontario New Housing Rebate Form. If you’re a homeowner or aspiring to become one in Ontario, this article will be your ultimate resource for understanding the rebate process, eligibility criteria, and how to maximize your benefits.

Homeownership is a dream for many, and the Ontario government understands the significance of making this dream a reality. The Ontario New Housing Rebate Form is a valuable incentive that can help you save money when purchasing a new home or making substantial renovations. Let’s dive into the details of this rebate form.

What is the Ontario New Housing Rebate?

The Ontario New Housing Rebate is a government initiative aimed at lessening the financial burden of homeowners. It allows you to recover a portion of the HST (Harmonized Sales Tax) you paid on the purchase of a new home or on substantial renovations to an existing home.

Eligibility Criteria

Before you can benefit from the Ontario New Housing Rebate, you must meet certain eligibility criteria:

1. Primary Residence

To qualify for the rebate, the property must be your primary residence. This means you intend to live in the home as your principal place of residence.

2. Purchase Price

The purchase price of your new home should not exceed $450,000 to be eligible for the full rebate. For homes exceeding this value, the rebate amount gradually decreases.

3. Renovation Requirements

If you’re looking to claim the rebate for substantial renovations, your renovation expenses should be at least $10,000. This typically includes major additions or alterations to the property.

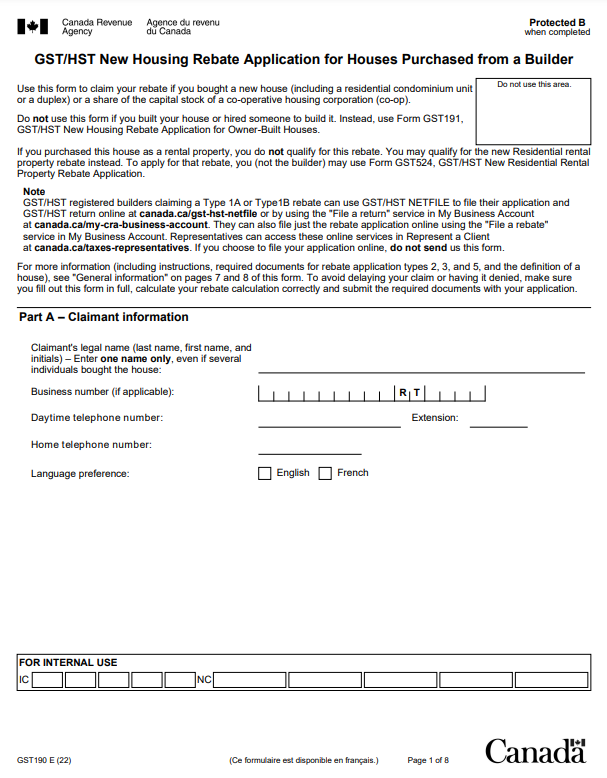

Filling Out the Ontario New Housing Rebate Form

To access the rebate, you need to complete the Ontario New Housing Rebate Form accurately. The form consists of several sections, including:

1. Personal Information

Provide your name, address, and contact details.

2. Property Details

Include information about the property, such as the address, purchase price, and builder details.

3. HST Paid

This section requires you to specify the amount of HST paid and any rebates or refunds you’ve already received.

4. Declaration

Sign the declaration, confirming that all the information provided is true and accurate.

Submission and Processing

Once the form is filled out, it needs to be submitted to the Canada Revenue Agency (CRA). It is essential to ensure all information is correct, as any discrepancies can result in delays or denials. After submission, the CRA will review your application and issue the rebate if you meet the eligibility criteria.

Maximizing Your Rebate

To make the most of the Ontario New Housing Rebate, consider these tips:

1. Keep Detailed Records

Maintain thorough records of all expenses related to your home purchase or renovations, including receipts and invoices.

2. Timely Submission

Ensure you submit your rebate application promptly after completing your home purchase or renovations.

3. Seek Professional Guidance

If you find the rebate process overwhelming, consider consulting with a tax professional who specializes in real estate.

Conclusion

The Ontario New Housing Rebate Form is a valuable resource for homeowners and aspiring homeowners in Ontario. By understanding the eligibility criteria, the application process, and the necessary steps to maximize your rebate, you can make the most of this government incentive.