PPI Tax Rebate Form – PPI Tax Rebate is a government initiative that allows individuals who have paid tax on their PPI claims to apply for a refund. Payment Protection Insurance is intended to cover loan repayments in the event of illness, accident, or unemployment. While it has been the subject of controversy in the past, individuals who were mis-sold PPI are entitled to a tax rebate on the interest they paid as part of their PPI claims.

Understanding Payment Protection Insurance (PPI)

Before diving into the rebate process, it’s essential to understand what PPI is. PPI is an insurance policy often sold alongside loans, credit cards, and mortgages. It is meant to provide peace of mind by covering repayments if the borrower faces unexpected financial hardships.

The Need for a PPI Tax Rebate Form

The need for a PPI tax rebate arises from the fact that the interest earned on PPI payouts is subject to income tax. If you have claimed PPI in the past, you may be eligible for a tax rebate on the interest portion, and this is where the PPI Tax Rebate Form comes into play.

Eligibility Criteria for Claiming PPI Tax Rebate

To be eligible for a PPI tax rebate, you must meet specific criteria. Typically, you need to have received a PPI payout and paid tax on the interest portion. Additionally, you must be a UK taxpayer. It’s important to note that not all PPI claimants will be eligible for a rebate.

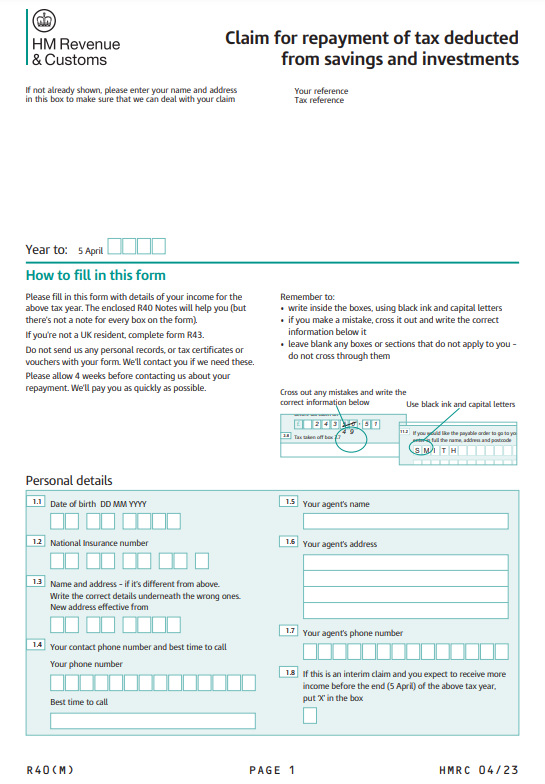

How to Obtain and Fill Out the PPI Tax Rebate Form

Obtaining the PPI Tax Rebate Form is a straightforward process. You can download it from the official government website or request a physical copy. Filling out the form involves providing personal details, information about your PPI claim, and details about the interest you paid tax on.

Documents Required for the Application

When applying for a PPI tax rebate, you will need to provide supporting documents. These may include PPI claim records, evidence of tax paid on the interest, and your tax-related information.

Submitting Your PPI Tax Rebate Form

Once your PPI Tax Rebate Form is complete, you can submit it online or by mail. Be sure to double-check all the details and attach the necessary documents to avoid delays in processing.

PPI Tax Rebate Processing Time

The processing time for a PPI tax rebate can vary, but it typically takes several weeks to a few months. During this time, HM Revenue & Customs will review your application and verify the information provided.

Receiving Your PPI Tax Rebate

Upon approval, you will receive your PPI tax rebate via direct deposit or a check in the mail. The rebate will cover the tax you paid on the interest portion of your PPI payout.

Common Mistakes to Avoid

It’s crucial to avoid common mistakes when applying for a PPI tax rebate. These include providing incorrect information, missing documents, or failing to meet the eligibility criteria. Careful attention to detail is key to a successful application.

Tips for a Successful PPI Tax Rebate Application

To increase your chances of a successful PPI tax rebate application, ensure you have all the required documents, provide accurate information, and submit your application promptly. Seeking professional advice may also be helpful.

Conclusion

Claiming a PPI tax rebate is an opportunity for individuals who have been mis-sold Payment Protection Insurance to recover the tax they paid on their PPI claims. By following the steps outlined in this guide and paying attention to the details, you can increase your chances of a successful rebate application. Don’t miss out on the opportunity to reclaim your hard-earned money.